Pay Resources

Pay resources include information on pay days for all employee types, pay calendars on all campuses, check cashing services for all employees, and other pay-related services based on your employment group.

Information & Resources

Pay Days

- University Officers of instruction, research, administration, and the libraries, and student officers, are on a semi-monthly pay frequency.

- Stipend and fellowship payments are paid monthly.

- Support staff and casual employees are generally paid every other Friday for the previous two-week period.

- Some service, maintenance, and dining service employees are paid weekly.

View Payroll Calendars

View your statement online:

- Log on to People@Columbia using your UNI and password (You will get the DUO authentication)

- Click on Payroll & Compensation tile

Note: Your year-to-date pay statement balance is reflected in each paycheck.

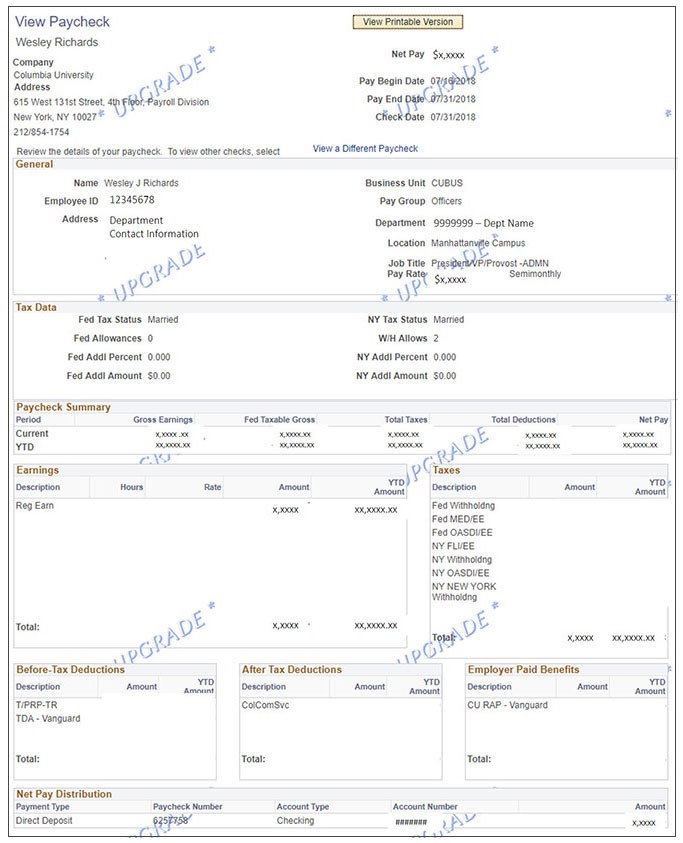

Sample Paycheck Statement

The sample pay statement provided indicates the “Earnings” and “Deductions” boxes. For detail descriptions see the Payroll Earnings Codes and Payroll Deduction Codes.

Sign up for the free direct deposit program, and your funds are automatically deposited to your bank account(s) each payday.

You elect a single direct deposit bank account or multiple accounts. Accounts can be selected based on a percentage of the total, flat dollar amounts, or as the balance of pay.

You can enroll, edit or inactivate your current election with immediate impact on your next paycheck.

How to Set Up Direct Deposit

- Log into the MyColumbia portal with your UNI and password

- Go to the "Faculty & Staff" page

- Under the "Personal Data Tab", choose "View and/or Update Personal Data"

Resources:

- Video: Setting Up Direct Deposit in PAC

- Note: when you click on the video link above, you will be asked to sign in with your UNI and password. Once on the page, simply click the blue "Enroll" button to begin.

- EBPA Transit-Parking Direct Deposit Form

Check cashing is available at any Chase branch upon the presentation of both a University ID Card and a government-issued ID.

For checks in excess of $500, in accordance with Chase policy and practice, employees who use this service will also be required to provide a fingerprint at the time of cashing their check.

In addition, Columbia employees may also cash their paycheck (only payroll checks and only up to a maximum of $4,000) at the following two Citibank locations, also with the presentation of both a University ID Card and a government-issued ID:

- 1310 Amsterdam Avenue, between 123rd and LaSalle Streets

- 2861 Broadway at 111th Street

Officers may request a vacation pay advance, equal to 65% of gross pay, by submitting a Salary Pay Advance Form to the PAC Service Center.

Such requests may be made only once a year. Advances for reasons other than vacation can be made only in extraordinary circumstances, once a year and with the written recommendation of the officer’s departmental administrator, dean, or vice president. These requests must also be submitted in writing to the PAC Service Center.

Support staff should consult the appropriate collective bargaining agreement for the guidelines regarding vacation pay advances.

If you are a regular full-time support staff employee in a department providing services beyond the normal work hours, or you work in a department on a 24-hour shift operation, you will receive a 10 percent shift differential if your work schedule begins between 3 pm and 5:59 am the next day.

Employees covered by a collective bargaining agreement should refer to the relevant agreement.

Officers, part-time employees, and temporary employees are not eligible for a shift differential.

The University follows criteria established under the Federal Fair Labor Standards Act (FLSA) to determine whether a position is exempt or non-exempt from the FLSA’s overtime provisions.

If you are an officer, you are considered an exempt employee and are not entitled to overtime pay.

If you are a support staff member, you will be paid one and one-half times your regular rate for any hours you work over your regularly scheduled full-time work week. Vacation, holidays, and personal days are treated as work days for the purpose of calculating overtime; no other absences, including paid sick leave, are considered work days in overtime calculations. Overtime must be approved in advance by your supervisor. Compensatory time-off in lieu of overtime pay must be taken within the same pay period that the overtime was incurred.

Employees covered under a collective bargaining agreement should consult that agreement.

New York State’s salary exemption threshold used by employers, including Columbia University, to classify employees as exempt or non-exempt is $1,125 per week ($58,500 annually).

Timesheets

A complete record of hours worked must be completed and submitted to your department at the end of each pay period. Timesheets are typically required no later than the Friday before the end of the pay period. However, please confirm with your local HR department for their timesheet submission deadlines. If you anticipate needing to work in excess of your standard hours, you must obtain prior approval from your manager.

Pay Frequency

You will be paid on the bi-weekly pay calendar, and will be paid every other Friday rather than twice per month. Each bi-weekly paycheck is slightly less than the semi-monthly paycheck, but you receive 26 paychecks per year rather than 24. Your annual rate remains the same. You can estimate your bi-weekly paycheck amount by multiplying your hourly rate by your standard hours in a two-week period (hourly rate *standard hours per week* 2).

Direct Deposit

If you have direct deposit with a fixed dollar amount deposited to more than one account, you must evaluate your distribution to ensure that your new bi-weekly rate will cover your direct deposit designations.

To make changes to your direct deposit election:

- Log in to MyColumbia

- Select the Faculty and Staff tab

- Select "View Your Direct Deposit Information"

Tax Withholding

Please evaluate your tax withholding elections to ensure that your tax withholding is appropriate for your new bi-weekly earnings and pay frequency.

If you have an additional tax amount deducted from each paycheck, that same deduction will be withheld from each bi-weekly paycheck. If you do not want the current additional withholding amount to be deducted in this manner, please evaluate your tax situation to ensure that your tax withholding is appropriate for your new bi-weekly earnings and pay frequency. Below are instructions to make changes to your withholdings.

To make changes to your Federal tax withholding:

- Log in MyColumbia

- Select the Faculty and Staff tab

- Select "View Your Tax Information"

To make changes to your State and/or local tax withholding:

- Complete a new IT-2104, available on the New York State Department of Taxation Website.

- Mail new IT-2104 to the HR Processing Center.

- If you work at the Medical Center, mail to the IT-2104 to the CUIMC Payroll Office

Contacts

Columbia University HR Processing Center

615 W. 131st Street

Studebaker Building, 4th Floor

Mailcode: 8702

New York, NY 10027

CUIMC Payroll Office

Black Building 1-126A

630 W. 168th Street

New York, NY 10032

Q: My manager told me I am changing to an Hourly Officer. When will I start being paid on an hourly basis?

- You will be paid on the bi-weekly pay calendar, and will be paid every other Friday rather than twice per month. Each bi-weekly paycheck is slightly less than the semi-monthly paycheck, but you receive 26 paychecks per year rather than 24. Your annual rate remains the same. You can estimate your bi-weekly paycheck amount by multiplying your hourly rate by your standard hours in a two-week period (hourly rate * standard hours per week * 2).

- The payroll schedules, including the deadline for submitting your record of hours worked, can be found at:

- Please note: some departments have earlier deadlines so please confirm with your manager or your department’s HR manager.

Q: Once I start getting paid on a bi-weekly basis, will I still get paid if I don’t submit my time sheet on time?

A: A complete record of hours worked must be completed and submitted to your department at the end of each pay period. Time records are typically required no later than the Friday before the end of the pay period. However, please confirm with your local HR department for their time record submission deadlines. Failure to submit a timely and accurate timesheet may result in disciplinary action.

If an unusual event occurs and you are unable to submit your time report before the deadline, you will be paid based on your standard hours in the HR system. However, the Payroll Office will not be able to process exception time (i.e., additional hours worked in excess of your standard hours, or any paid time off for which you are eligible) without your time sheet. Any exception time will be processed in the next bi-weekly payroll following the submission of your timesheet and your manager’s approval.

Q: Does the change in pay schedule affect my direct deposit?

A: If you have direct deposit with a fixed dollar amount deposited to more than one account, you must evaluate your distribution to ensure that your new bi-weekly rate will cover your direct deposit designations.

To make changes to your direct deposit election:

- Log in to MyColumbia

- Select the "Faculty and Staff" page

- Scroll down to the "Personal Data" tab

- Select "View and/or Update Your Personal Data"

Q: How will my tax withholdings be affected by the change to bi-weekly payroll?

A: Please evaluate your tax withholding elections to ensure that your tax withholding is appropriate for your new bi-weekly earnings and pay frequency. If you have an additional tax amount deducted from each paycheck, that same amount will be deducted from each bi-weekly paycheck. Below are instructions to make changes to your withholdings.

To make changes to your Federal tax withholding:,

- Log in to MyColumbia

- Select the Faculty and Staff tab

- Select "View Your Tax Information."

To make changes to your State and/or local tax withholding:

- Complete a new IT-2104, available on the New York State Department of Taxation Website.

Columbia University HR Processing Center

615 W. 131st Street

Studebaker Building, 4th Floor

Mailcode: 8702

New York, NY 10027

CUIMC Payroll Office

Black Building 1-126A

630 W. 168th Street

New York, NY 10032

Q: What if I pay some of my bills through automatic bill pay set up?

If you have automatic bill pay set up for any regular expenses (e.g., mortgage payments, car payments, student loan payments, cable bill, phone bill, credit cards, etc.), you may wish to review the timing of those payments to ensure they align with your new bi-weekly pay frequency.

Q: How are my benefits deductions affected by the change in pay frequency?

- Health and Welfare Deductions (examples include medical, dental, transit, etc.): Benefits contributions will continue to be deducted twice monthly. However, deductions are taken on the first two paychecks of each month. If there is a third bi-weekly payroll in a month, no Health and Welfare deductions will be taken on that paycheck.

- Healthcare Flexible Spending Account (FSA) contributions: Your annual FSA contribution will remain the same as you elected. The monthly contribution amount will be split over the first two paychecks of each month.

- Dependent Care Flexible Spending Account (FSA) contributions: Your annual Dependent Care FSA contribution will remain the same as you elected. Monthly contributions will be split between the first two paychecks of each month. As a reminder, your reimbursement for eligible Dependent Care FSA expenses cannot exceed the contributed balance of your account at the time of your claim.

- Transit/Parking contributions: Your annual Transit/Parking contribution will remain the same as you elected. Monthly contributions will be split between the first two paychecks of each month. Your reimbursement for eligible Transit/Parking expenses remains the same as it is today. It cannot exceed the elected amount for the month.

- CU Retirement Plan contributions received from the University: There are no changes. The University contributions will continue to be sent to the investment carrier(s) once a month. However, you will see the contribution amounts calculated based on eligible earnings being paid reflected on each bi-weekly paycheck.

- Voluntary Retirement Savings Plan (VRSP) deductions: VRSP contributions will be deducted on each bi-weekly paycheck based on eligible earnings being paid on the paycheck. Contribution will be remitted to investment vendor(s) following each bi-weekly payroll.

Please note: You can make changes to your VRSP contributions at any point during the year.

If you have any additional questions regarding your benefits deductions, please contact the Benefits Service Center at (212) 851-7000.